Also read all about income tax provisions for TDS on rent. Uttar Pradesh e-Stamp Certificate can be used for all instruments on which stamp duty is payable.

Tenancy Agreement Stamping Service Rental Agreement Penyeteman Perjanjian Sewa Rumah Lhdn Shopee Malaysia

The amount of stamp duty currently payable on the instrument will be shown.

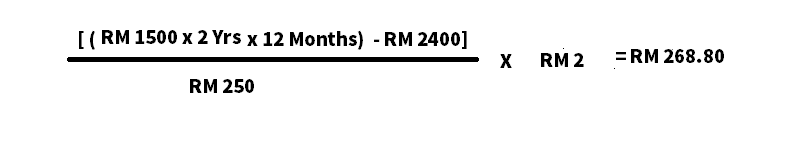

. So if you need to be on a safer side you can make the agreement on a Stamp paper of the appropriate value as prescribed by the government. Get the right guidance with an attorney by your side. Rather than a single fixed fee stamp duty for tenancy agreements are calculated based on every RM250 of the annual rental.

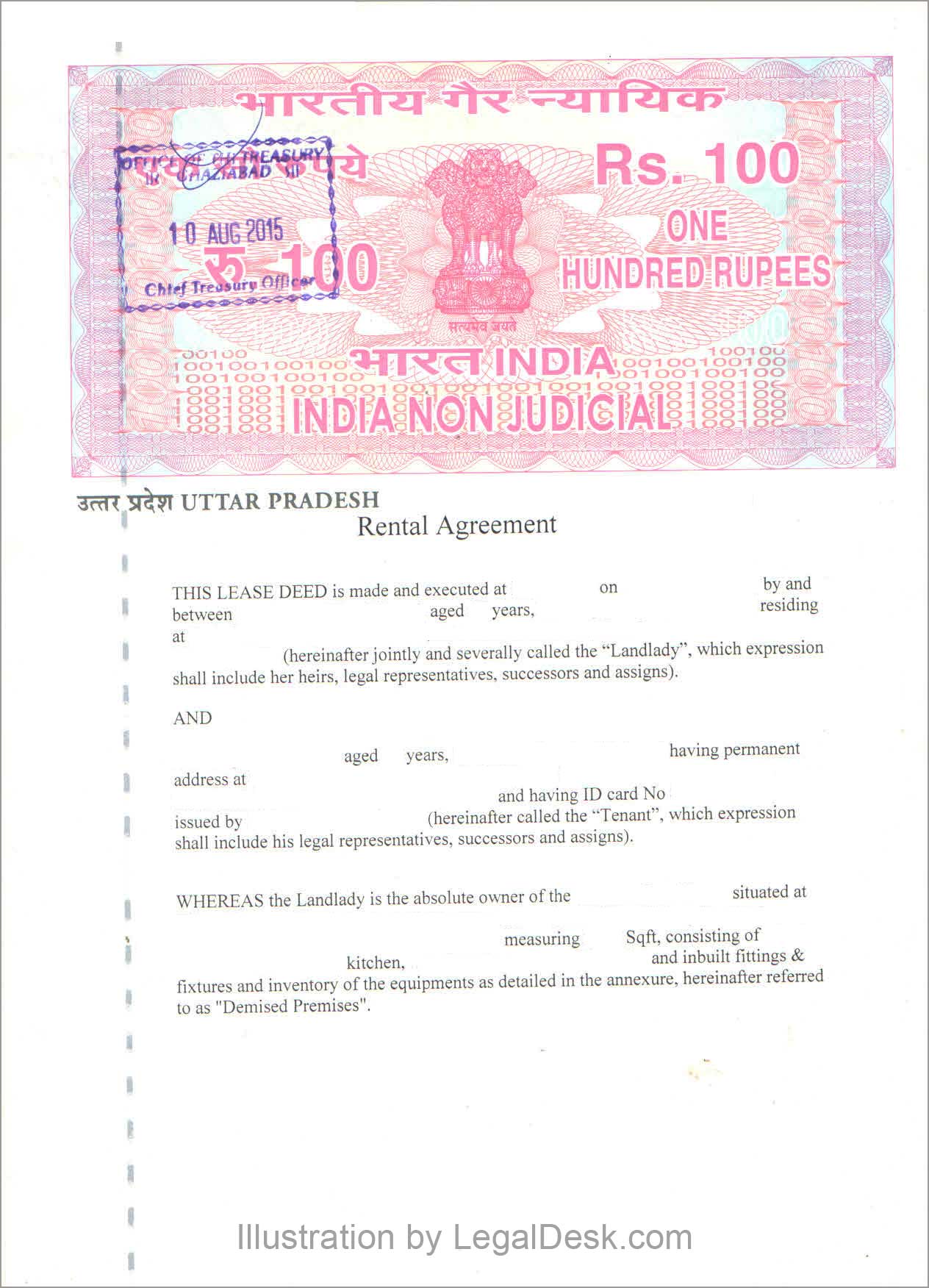

A rental agreement also called a rent deed and lease deed contains basic details of the residential property the owner of the property the renter or tenant as he is also called the term of the rental and the amount of the rent for the said term. 332 To pay the Stamp Duty charged on the original and counterpart of this Agreement if any. 13 STEP 422 Retrieve Stamp Certificate.

Under the recently passed Model Tenancy Act 2019 states could set up rent authorities in cities where landlords and tenants would have to go to the rent agreement registered. Parties to a tenancy document are liable to pay stamp duty on the document according to Schedule 1 of the Stamp Duty Ordinance Cap. It is for your.

Rental Stamp Duty Calculator helps you determine the amount of stamp duty payable to IRAS for the tenancy agreement signed. There are several distinct ways in which dual occupancies can be regulatedFor example by strata subdivision by separate titles or as one title as tenants in common with a agreement in place regulating the use of the propertyAt one stage tenancy in common agreements were used not only in duplexes but also in blocks of 3 or 4 flats. However the central government fixes the stamp duty rates of specific instruments.

Stamp duty rates differ in various states across the country as stamp duty in India is a state subject. The Tenant shall be liable to pay stamp duty. Processing fee and stamp duty.

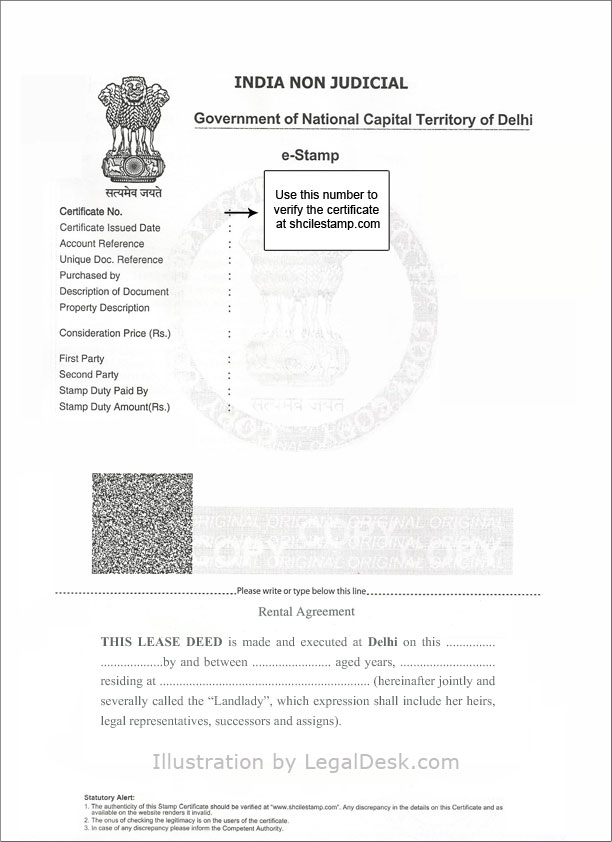

How Much Is Stamp Duty For Tenancy Agreement In 20202021. Place the Signature of both Owner and Tenant. The online rent agreement is drafted on e-stamp paper having denomination value of Rs 100.

Iii However prior to the completion of a year Tempoh kontrak year period from the date hereof-. Additional Key Updates to the PIMS Tenancy Agreement 1st JUNE 2019 Changed to Contractual Periodic Councils have a habit of trying to pursue landlords for unpaid Tenant council tax for they imply a continuation as a periodic is a new contract and therefore a minimum of being less than 6 months whereas a contractual periodic may provide. Uses of e-stamps.

You need to pay a stamp duty when you buy a property and also when you go in for a rental agreement. 2 Pay Stamp Duty 3 Download Stamp Certificate Complete e-Stamping in 3 Stages. Based on the table below this means that for tenancy periods less than 1 year the stamp duty fee is RM1 per RM250.

Purchase Agreements Tenancy Agreements Share Transfer and Mortgages. Stamp duty is the governments charge levied on different property transactions. Of this Rs 100 is paid as the stamp.

The agreement should be printed on a Stamp paper of minimum value of Rs100 or 200-. Sample of e-Stamp Paper Once the Drafting gets Complete. As mentioned above a delay in the payment of stamp duty will attract a penalty of 2 every month up to 200 of the remaining amount.

20- and preferable Rs. The rental agreement is generally in written form and drafted on stamp paper. E-stamps can be used in regard to all instruments on which stamp duty is payable.

Yes if somehow you do not register the rent agreement with the authorities you may end up paying 10 times the original amount plus the outstanding registration charges and stamp duty charges. Such instrument incorporates all transfer documents such as sale deeds mortgage deeds exchange deeds gift deeds conveyance deeds and power of attorney deed of partition lease deed agreement of tenancy leave and license agreement. 50- though after introducing e-stamp paper no fixed denomination is left.

The Schedule which contains clauses relating to the main aspects of a tenancy for parties to. Stamp duty is 1 of the total rent plus deposit paid annually or Rs. Please input the tenancy details and then press Compute.

H D B F L A T T E N A N C Y A G R E E M E N T P a g e 3 of 18 16. Stamp duty is payable under Section 3 of the Indian Stamp Act 1899. 500- whichever is lower.

Duration Of Tenancy It should be clearly stated in the Agreement what will be the duration of the Tenancy. 50- or higher to avoid any misshapen in terms of Legal Crises Later. In the absence of any such agreement the Act provides that in the case of a Conveyance duty is.

Our network attorneys have an average customer rating of 48 out of 5 stars. 47 Who bears and pays the stamp duty is a matter of agreement between the parties. 331 Within the last 1 month of the tenancy to permit the Landlord or any person authorised by the Landlord or the Landlords Agent at reasonable hours of the day or night to enter and view the property with prospective Tenants or purchasers.

If your tenancy period is between 1 3. Stamp duty on rental agreements. In Karnataka the least Stamp Duty for Rental Agreement is Rs.

This is for any rental property that has been leased out to tenants by landlords. Stamp Duty Computation Landed Properties - Tenancy Agreement. Such instruments include all transfer documents such as sale agreement mortgage deed conveyance deed exchange deed gift deed power of attorney agreement of tenancy deed of partition lease deeds leave and license agreement etc.

The rate of stamp duty varies with the termperiod of the tenancy. Stamp Lease Tenancy Agreement 12 - This segment has been intentionally left blank - 21012022INLSHAIVer23. The expression co-owners includes all kinds of co-ownership such as joint tenancy tenancy in common coparcenary membership of HUF etc.

Ii After completion of Tempoh kontrak year tenancy period from the date hereof if the Tenant desires to terminate the Tenancy Agreement before the expiration of the term hereby created the Tenant shall be required to give a three 3 month written notice of such sooner determination. The following tenancy agreement template is divided into three main sections. DIPLOMATIC BREAK CLAUSE.

You can make Rent Agreement on e-Stamp Paper of any amount still it is always recommended to make Rent Agreement on a Stamp paper of Rs. For more information about rental stamp duty you can read a. The prescribed Stamp Duty for Rent Agreement in Delhi is Rs.

117 of the Laws of Hong Kong. How is stamp duty calculated on a tenancy document. 2 2 1 STEP 10 Login Go to e-Stamping Portal.

Members of the public and agents lawyers property agents managing agents can use the e-Stamping service to pay stamp duty on their documents such as Sale. The amount of the current stamp duty payable is computed according to the information that you have entered. Stamp duty is a tax on certain written documents that evidence transactions.

Stamp Duty And Administration Fee 2 Important Aspects For Tenancy Agreement In Malaysia

Tenancy Agreement In Malaysia Complete Guide And Sample Download

Drafting And Stamping Tenancy Agreement

If A Tenant Damages Your Property In Malaysia Asklegal My

Tenancy Agreement Stamp Duty Malaysia Financial Blogger Ideas For Financial Freedom

Legaldesk Com Delhi Rental Agreement All You Need To Know

Stamp Duty And Administration Fee 2 Important Aspects For Tenancy Agreement In Malaysia

Stamp Duty And Administration Fee 2 Important Aspects For Tenancy Agreement In Malaysia

7 Rookie Mistakes Landlords Make How To Avoid Them Youhomesg

Why You Should Get Your Rent Agreement Registered

Tenancy Agreement In Malaysia The Ultimate Guide Speedhome Guide

Tenancy Agreement Stamp Duty Calculator Malaysia

Contactless Rental Stamp Duty Tenancy Agreement Runner Service Thanks Madam For The Support Facebook

Contactless Rental Stamp Duty Tenancy Agreement Runner Service Thank You Mr Wong To Support Facebook

Notarized Or Registered Rent Agreement Which Is Better